The salary calculator has been updated with the latest tax rates which take effect from april 2021. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information.

The Best Payroll Service For Sole Proprietors Or S Corp

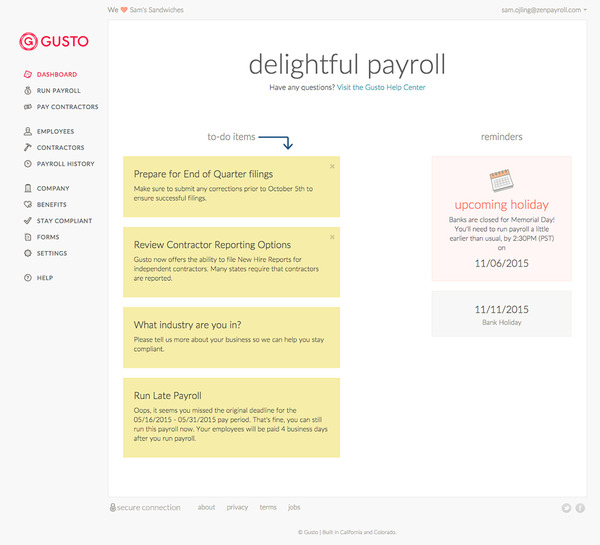

Running the payroll, hiring new employees, making sure everything is compliant, and oh yeah, building your business.

Gusto colorado paycheck calculator. $10/month for up to 5 employees, $1.00/employee/month for additional employees. The aggregate method, which you'll use if you pay supplemental and regular wages at the same time, is a little more complicated and requires you to check out the tax rates listed on irs publication 15. Note that these are marginal tax rates, so the rate in question only applies to the income that falls within that bracket.

Includes federal, state, county & city labor law notices + all updates. Overview of colorado taxes colorado is home to rocky mountain national park, upscale ski resorts and a flat income tax rate of 4.63%. You’re the one who does everything at your company.

And 4.50% on income beyond $159,000. Gusto’s mission is to create a world where work empowers a better life. It determines the amount of gross wages before taxes and deductions that are withheld, given a specific.

Free payroll and hr resources. Switch to colorado salary calculator. The calculator on this page uses the percentage method, which calculates tax withholding based on the irs's flat 22% tax rate on bonuses.

Use this federal gross pay calculator to gross up wages based on net pay. Under fica, you also need to withhold 1.45% of each employee’s taxable. Use this calculator to estimate the actual paycheck amount that is brought home after taxes and deductions from salary.

The employee social security tax is 6.2% on $142,800 of earned income. It should not be relied upon to calculate exact taxes, payroll or other financial data. Withhold 6.2% of each employee’s taxable wages until they earn gross pay of $142,800 in a given calendar year.

If you have several debts in lots of different places (credit cards, car loans, overdrafts etc), you might be able to save money by. Below are the social security tax rates for 2021. Gusto serves over 200,000 companies nationwide and has offices in san francisco, denver, and new york.

The paycheck calculator is designed to estimate an employee’s net pay after adding or deducting things like bonuses, overtime, and taxes. Use smartasset's paycheck calculator to calculate your take home pay per paycheck for both salary and hourly jobs after taking into account federal, state, and local taxes. This colorado hourly paycheck calculator is perfect for those who are paid on an hourly basis.

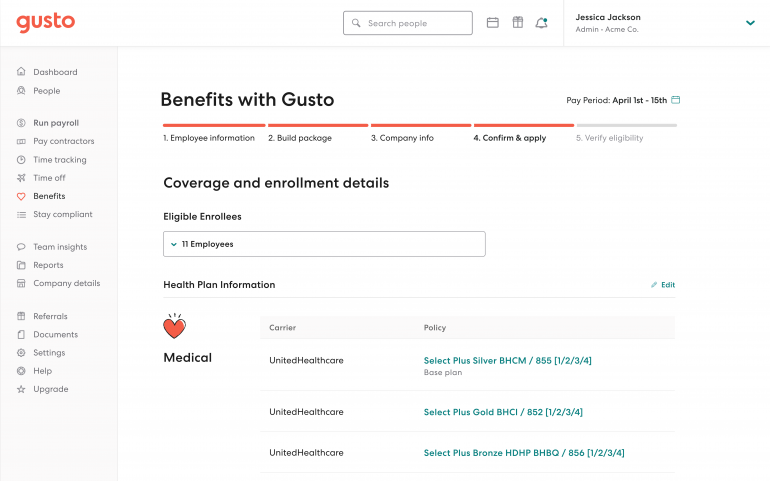

Gusto is here to help. As long as the loan is put only towards eligible payroll and business expenses, it does not need to be repaid. By making the most complicated business tasks simple and personal, gusto is reimagining payroll, benefits and hr for modern companies.

This federal hourly paycheck calculator is perfect for those who are paid on an hourly basis. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal, state, and local w4 information. The employer social security tax is 6.2% on $142,800 of earned income.

This calculator is intended for use by u.s. Paycheck manager's free payroll calculator offers online payroll tax deduction calculation, federal income tax withheld, pay stubs, and more. Filing as a single person in arizona, you will get taxed at a rate of 2.59% on your first $26,500 of taxable income;

The maximum an employee will pay in 2021 is $8,853.60. As the employer, you must also match your employees’ contributions. Unlike most hr platforms, zenefits’ payroll system automatically syncs with the rest of hr, making your life a little bit easier.

The calculator on this page is provided through the adp employer resource center and is designed to provide general guidance and estimates. More than 200,000 small businesses and their teams trust gusto.

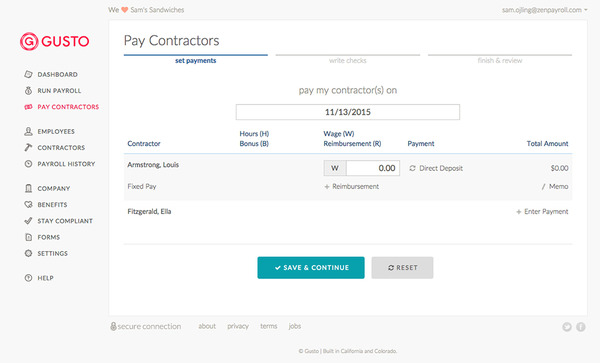

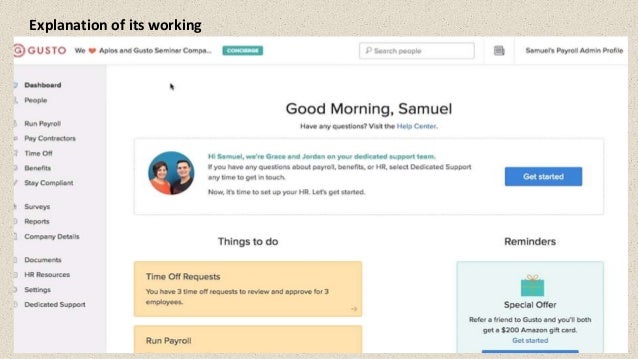

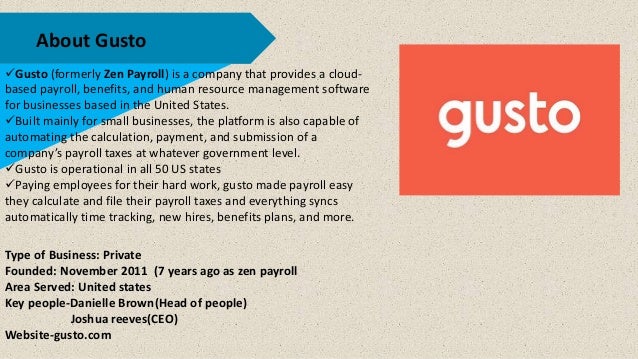

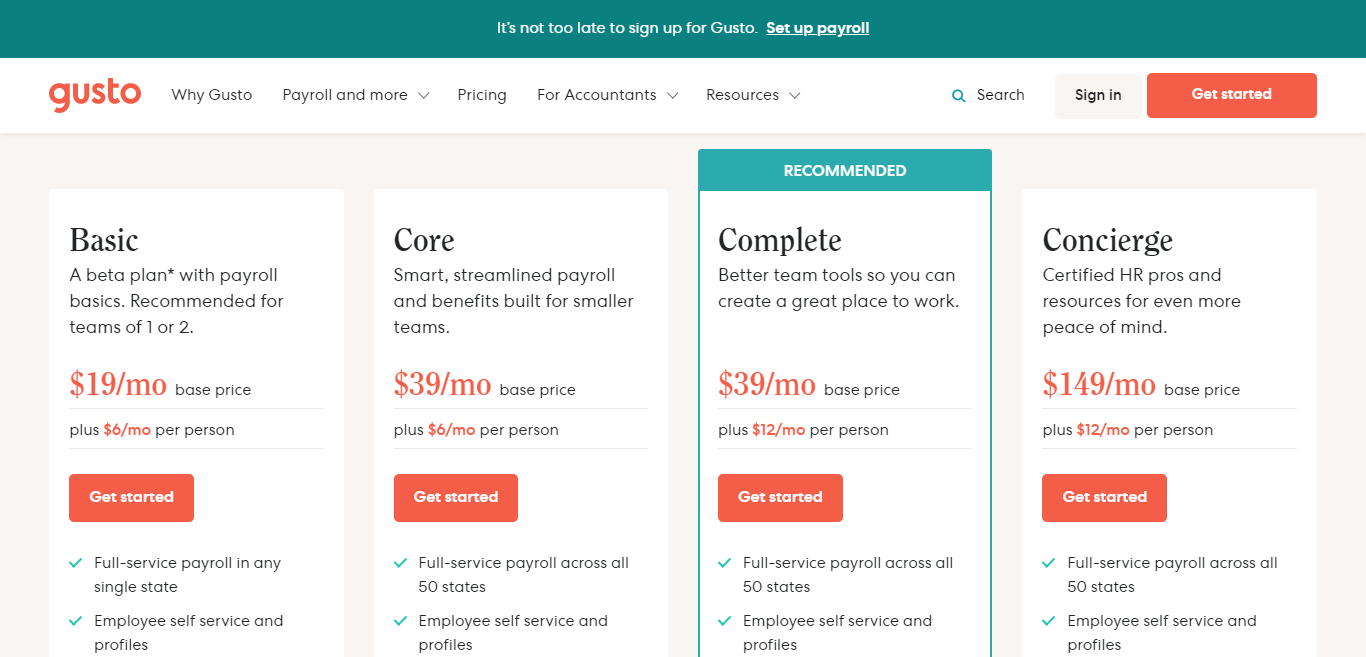

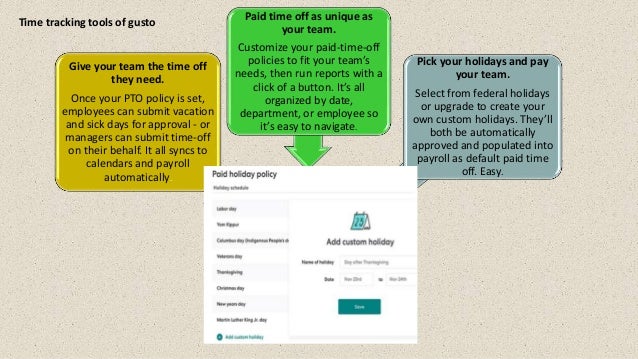

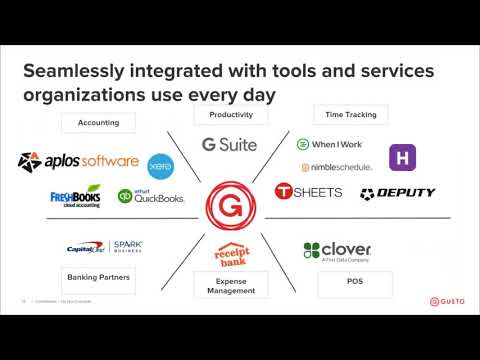

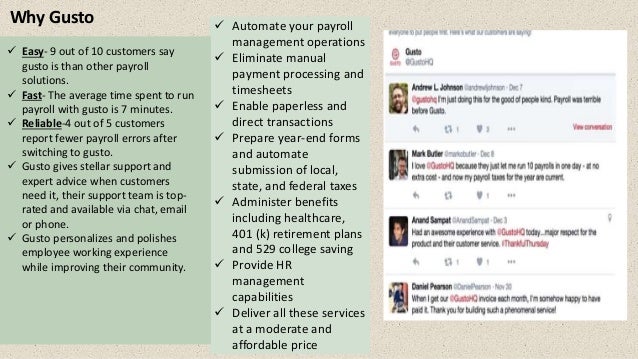

Presentation On Gusto Payroll

Colorado Paycheck Calculator - Smartasset

Free Salary Comparison Calculator By Job And State Gusto

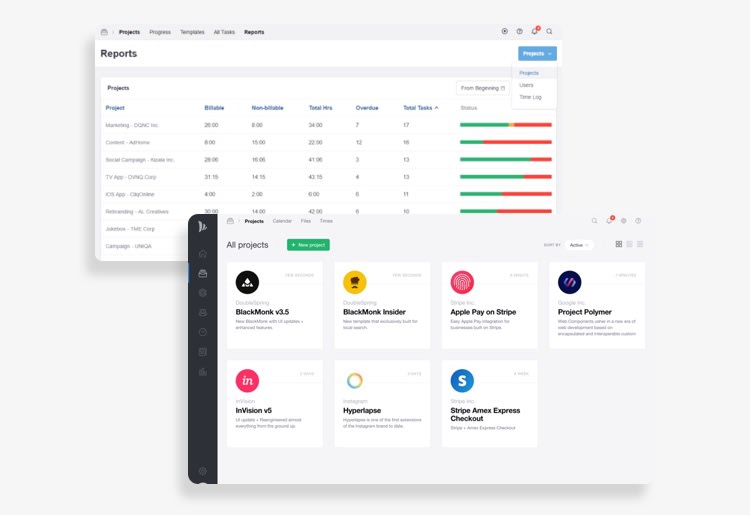

Top 3 Payroll Software Comparison Of Gusto Sage 50cloud Payroll And Onpay - Financesonlinecom

Free Salary Comparison Calculator By Job And State Gusto

Gusto Payroll Processor Review

Top 3 Payroll Software Comparison Of Gusto Sage 50cloud Payroll And Onpay - Financesonlinecom

Presentation On Gusto Payroll

Gusto Review Is This The Best Payroll Service Right Now

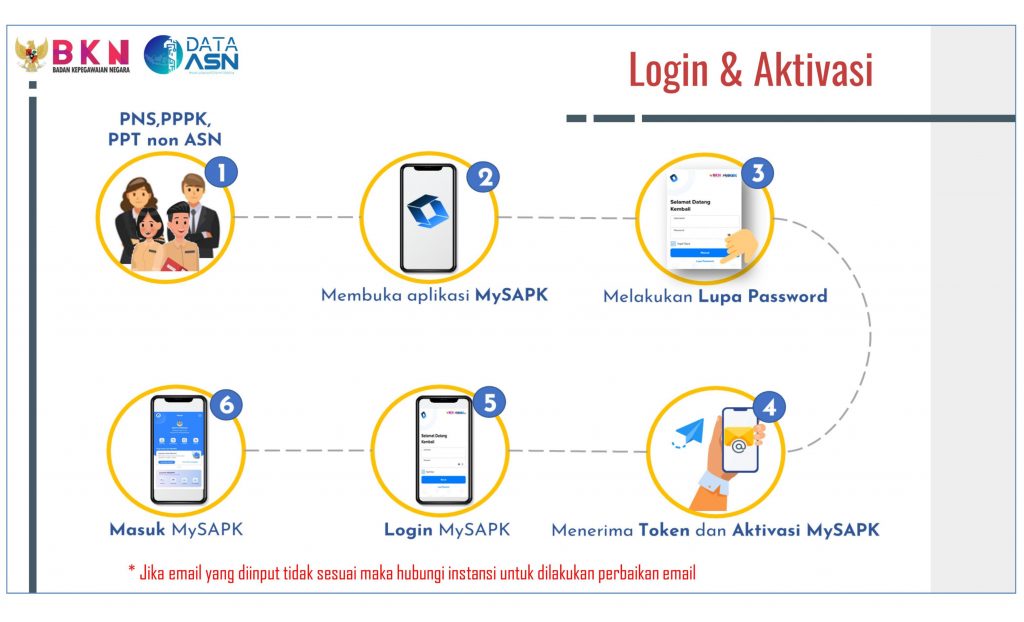

Langkah-langkah Aktivasi Akun Mysapk Bkd Kalimantan Tengah

Presentation On Gusto Payroll

Langkah-langkah Aktivasi Akun Mysapk Bkd Kalimantan Tengah

Presentation On Gusto Payroll

Gusto Payroll Processor Review

Heres How To Read A Pay Stub With Sample Paycheck - Youtube

Presentation On Gusto Payroll

Gusto Payroll Review 2021 Features Hr Capabilities Pricing - Nerdwallet

The Best Payroll Service For Sole Proprietors Or S Corp

Pemutakhiran Data Mandiri Pdm Pemerintah Provinsi Kalimantan Tengah Bkd Kalimantan Tengah